CFO Cash flow from operations. Market Capitalization Formula 20000000 x 12 12 million.

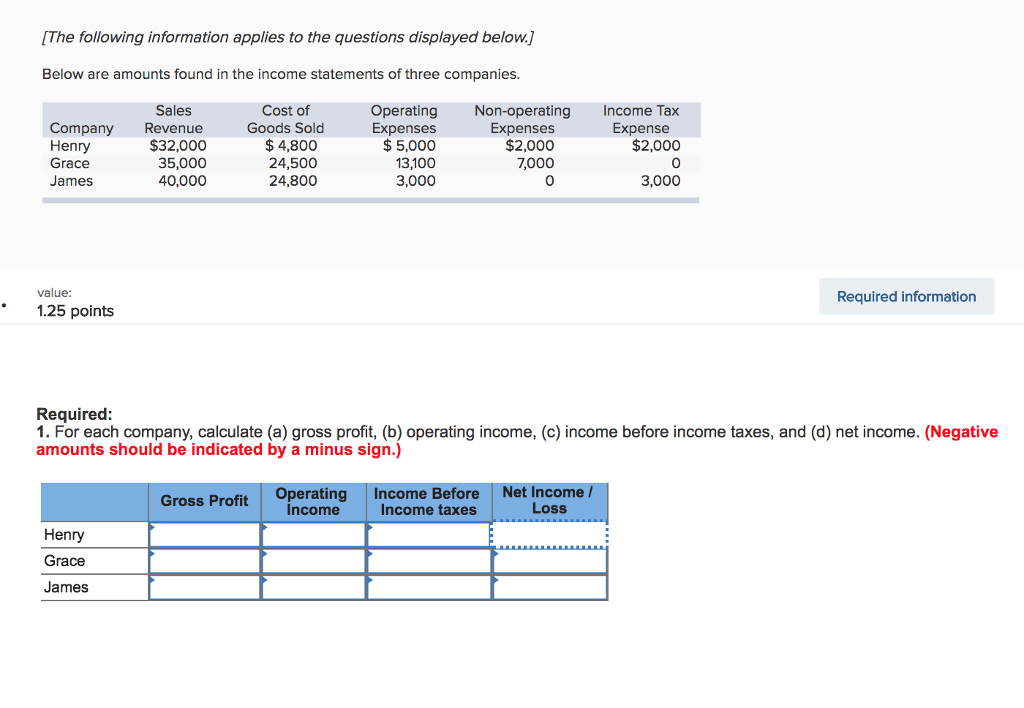

Solved The Following Information Applies To The Questions Chegg Com

A dental practices sale price is typically two to four times its EBITDA figure.

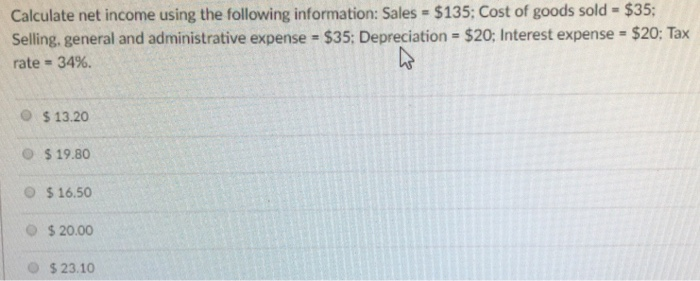

. 80 crore X 100. Net income formula tips. Depreciation 20 Interest expense 20.

Its the amount of money you have left to pay shareholders invest in new projects or equipment pay off debts or save for future use. Gain loss from disposal of a discontinued component. Determine how much you earn before taxes.

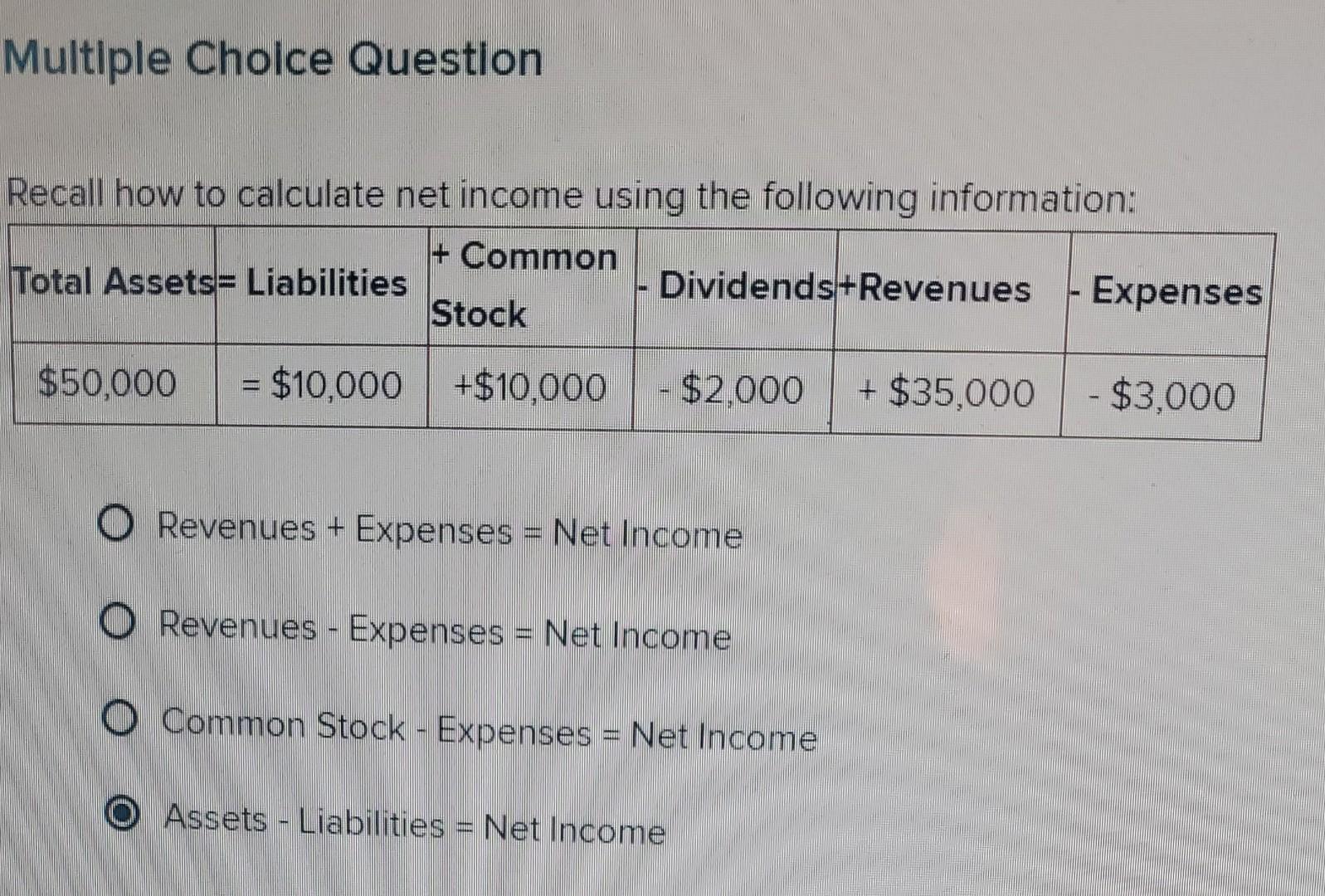

View the full answer. Net income total revenue total expenses. Calculate net income using the following information.

The closing entries for Bills Sporting Goods appear on the following page. Return on Revenue Ratio Net Income Total Sales Revenue. When calculating its net cash flow from operating activities a firm subtracts 18000 from its net income in relation to an amortization transaction.

Incomeloss from the operations of a discontinued component. Which of the following statements describes the effect of expenses on equity. The formula for calculating net income is.

You can easily find the net income and sales revenue figures reported on a companys income statement. Lets say you want to find your companys net income for the month of March. O Revenues - Expenses Net Income.

ΔWorking Capital Change in working capital. Common Total Assets Liabilities Dividends Revenues Expenses Stock. An income statement reports a companys net income or net loss during a period.

Recall that the cash from operations is calculated using the formula below. Net Patient Service Revenues Provision for Bad Debts Net Patient Service Revenues less Provision for Bad Debts Other Operating Revenues. In this method income refers to your EBITDA or earnings before interest taxes and depreciation amortization.

Find a previous pay periods pay stub and locate your deductions if there are any. The following steps outline how you calculate current income tax provision. 80 crore and Total Dividend is Rs.

To calculate net income youll use the following formula. Recall how to calculate net income using the following information. Start with your companys net income.

Based on the above-given information and the formula of Market Cap we will be able to calculate ABC Companys market capitalization. This is your income as calculated by GAAP rules before income taxes. Heres how to calculate investment income.

Which of the following accounts would appear on an income. Sales 135 Lesscost of goods sold 35 Gros. How to calculate net income using the following information.

Calculate the current years permanent differences. The very first step is to find your gross income or the total amount of money you earn before deductions. As a 35000 deduction from net income and a 325000 increase in cash flows from investing activities.

Subtract your business expenses taxes and operating costs from your gross income. 1320 1980 О 1650 2000 О 2310. Or you can use the following formula to calculate net income.

Common Total Assets Liabilities - DividendsRevenues Expenses Stock 50000 10000 10000 2000 HI 35000 - 3000 O Revenues Expenses Net Income O Revenues - Expenses Net Income O Common Stock. By definition owner investments are cash or other assets that an owner or owner contributes to the company. The shares which are available in the open market are called floats.

Cost of goods sold Selling. Prepare an income statement using the following information for CK Company for the month of February 2019. Expenses cause equity to decrease.

These are income items or expenses that are not allowed for income tax purposes but that are allowed for GAAP. Find your total revenue or gross income. Similar to the net profit margin ratio to find this ratio you just need to take the net income and then divide it by the total sales revenue.

At the same time FCFE from net income is calculated through the following formula. For example if an investment that costs 100000 yields 3 investment income will be 3000 a year. O Revenues Expenses Net Income.

Multiply investment cost by the yield to get the amount of annual income. Recall the importance of closing. You can calculate this income based on either your discounted cash flows or your capitalized profits.

Revenue minus cost of goods sold. FCFE Net Income Depreciation Amortization. Subtract what is owed.

Cost of goods sold. Recall how to calculate net income using the following information. To transfer the net income to retained earnings and reset the income statement accounts to zero in preparation for the next accounting period.

Operating SectionSeveral unique items of revenue are included in the operating section. Determine your gross annual income. Multiple Choice Question Recall.

The payout ratio will be calculated using the same formula as mentioned above-Payout Ratio Total Dividends Net Income. Here are the facts. Revenues - Expenses Net Income 61.

Recall how to calculate net income using the following information. Net Income is Rs. The first part of the formula revenue minus cost of goods sold is also the formula for gross income.

Recall how to calculate net income using the following information. We must also remember that not all shares are traded in an open market. Total Assets Liabilities Owners Capital - Owners Withdrawals Revenues - Expenses 50000 10000 10000 - 2000 35000 - 3000.

Operating Income Nonoperating Gains Losses Change in Net Assets Beginning Net Assets Ending Net Assets 2. Net Income Revenue Cost of Goods Sold Expenses. 40 crore Rs.

50000 10000 10000 2000 HI 35000 - 3000. Total Assets Liabilities Common Stock Dividends Revenues-Expenses 50000 10000 10000 34. Figure Prepare a statement of owners equity using the following information for the Can Due Shop for the month of September 2018.

This adjustment suggests that the transaction involved amortization of bond _____. It will serve as a solid foundation for calculating your net income. As a result many practices calculate their market value based on their revenue and expenses.

Revenue Cost of Goods Sold Expenses Net Income. CFO Net Income Depreciation Amortization ΔWorking Capital. Revenues - Expenses Net Income If a customer makes a partial payment of 100 on a service for which you have already billed him you would record this transaction into the accounting equation by.

O Common Stock - Expenses Net Income. The result of this calculation may be negative which occurs when expenses exceed revenues. Net income formula example.

Accounting questions and answers. General and administrative expense- 35. 2000 35000 3000 Revenues-ExpensesNet Income 35.

As a result all income statement accounts with a credit balance must be debited and vice versa. Multiple Choice Question Recall how to calculate net income using the following information.

Solved 35 Calculate Net Income Using The Following Chegg Com

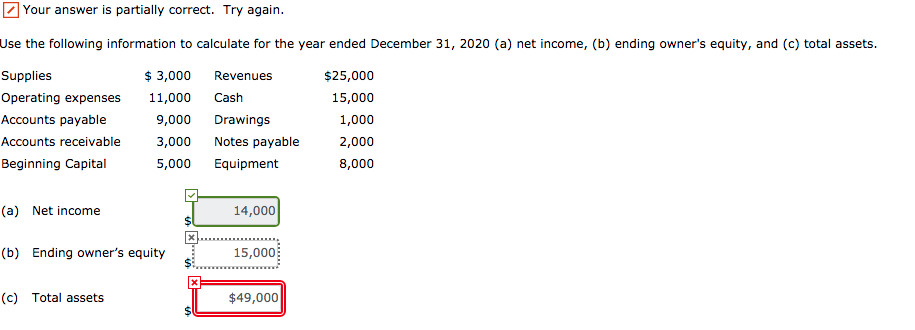

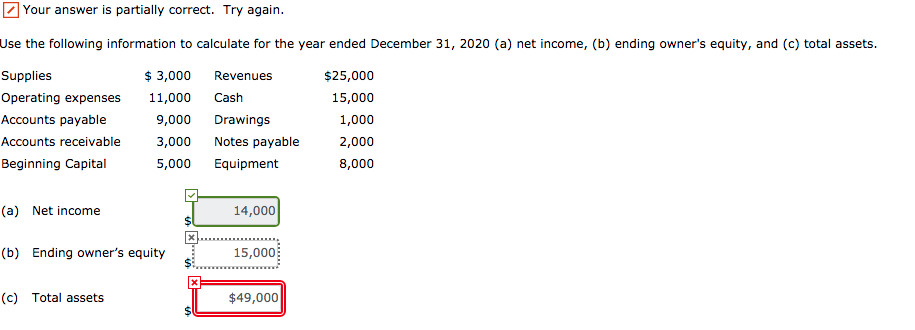

Solved Use The Following Information To Calculate The Chegg Com

Solved Your Answer Is Partially Correct Try Again Use The Chegg Com

Solved Multiple Choice Question Recall How To Calculate Net Chegg Com

0 Comments